CHUBB Insurance

Company Profile: The origins of CHUBB® Corporation date back to 1882 when Thomas Caldecot Chubb and his son Percy opened their marine underwriting business in the seaport district of New York City. By 1900, Chubb had established strong relationships with the insurance agents and brokers who placed their clients’ business with Chubb underwriters. Products are now distributed through more than 14,000 independent agents and brokers in North America and employs more than 30,000 people worldwide.

CHUBB® is the world’s largest publicly traded P&C insurance company and the largest commercial insurer in the U.S. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance to a diverse group of clients. As an underwriting company, they assess, assume, and manage risk with insight and discipline and service and pay claims fairly and promptly. They combine the precision of craftsmanship with decades of experience to conceive, craft and deliver the very best insurance coverage and service to individuals and families, and businesses of all sizes. ACE was established in 1985 in response to an availability crisis in the U.S. insurance marketplace for excess liability and directors’ and officers’ insurance coverage. From its inception through the 1990s, ACE grew rapidly through product diversification, strategic partnerships, and acquisition. A true turning point for ACE was its 1999 acquisition of Cigna Corporation’s international and domestic property and casualty business. The acquisition gave ACE an instant global network and simultaneously transferred INA’s 200-year history to the company. By the time, ACE acquired CHUBB®, ACE had grown into a leading global insurer serving customers from the largest multinational companies to individuals and families around the world.

Financial Stability:

Company Highlights:

Industry Rankings:

Products Offered

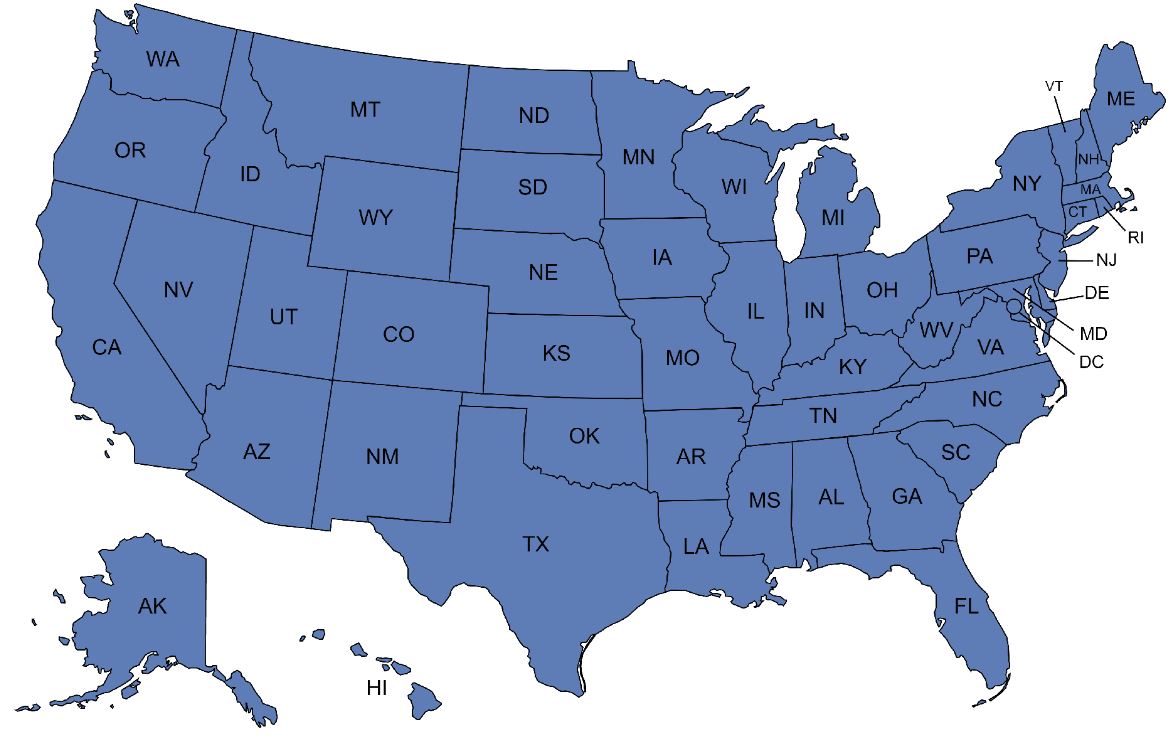

Operating Territory

|

- Why IAN

- About IAN

- Carriers/Partners

- Technology

- Programs

-

Insurance

- Associates

-

Vendors/Services

- ADP

- Agency Revolution

- Agentero

- Applied Systems

- Archway Computers

- Blue Jay Reviews

- Bold Peguin

- Bonjoro

- Bridge

- Brightfire

- Canopy Connect

- Capital Premium

- DocuSign

- epay Policy

- EZLynx

- Forge3

- Formstack

- GoDaddy

- Google Workspace

- GoToConnect

- Grasshopper

- Hawksoft

- IBQ Systems

- Indio

- InsuranceSplash

- ITC

- Levitate

- Malwarebytes

- Ooma

- Relativity6

- Ring Central

- Rocket Referrals

- Semsee

- ShareFile

- Tarmika

- Vertafore

- Virtru

- Wahve

- Wingman Cyber

- zix

- Zywave

- Access Online Documents

- Contact

- Why IAN

- About IAN

- Carriers/Partners

- Technology

- Programs

-

Insurance

- Associates

-

Vendors/Services

- ADP

- Agency Revolution

- Agentero

- Applied Systems

- Archway Computers

- Blue Jay Reviews

- Bold Peguin

- Bonjoro

- Bridge

- Brightfire

- Canopy Connect

- Capital Premium

- DocuSign

- epay Policy

- EZLynx

- Forge3

- Formstack

- GoDaddy

- Google Workspace

- GoToConnect

- Grasshopper

- Hawksoft

- IBQ Systems

- Indio

- InsuranceSplash

- ITC

- Levitate

- Malwarebytes

- Ooma

- Relativity6

- Ring Central

- Rocket Referrals

- Semsee

- ShareFile

- Tarmika

- Vertafore

- Virtru

- Wahve

- Wingman Cyber

- zix

- Zywave

- Access Online Documents

- Contact