Progressive InsuranceCompany Profile: PROGRESSIVE was started in 1937. On March 10, 1937, Joseph Lewis and Jack Green started Progressive Mutual Insurance Company. They wanted to provide vehicle owners with security and protection, and they thought an insurance company was a good investment for a couple of lawyers who were just getting started. Their business philosophy was to approach auto insurance in an innovative way—like no other company had. The Progressive Corporation is now one of the largest providers of car insurance in the United States. The company also insures motorcycles, boats, RVs, and commercial vehicles, and provides home insurance through select companies.

PROGRESSIVE has taken an innovative approach to auto insurance. They offered drive-in claims service before any other auto insurance company, and, in another industry first, allowed customers to pay their premiums in installments — an appealing option for those who couldn't afford annual payments. Progressive wanted — and still wants — to make auto insurance accessible and easy so more people could protect their vehicles.

Financial Stability:

Employee, Customer and Community Oriented:

Company Highlights:

Industry Rankings:

Products Offered

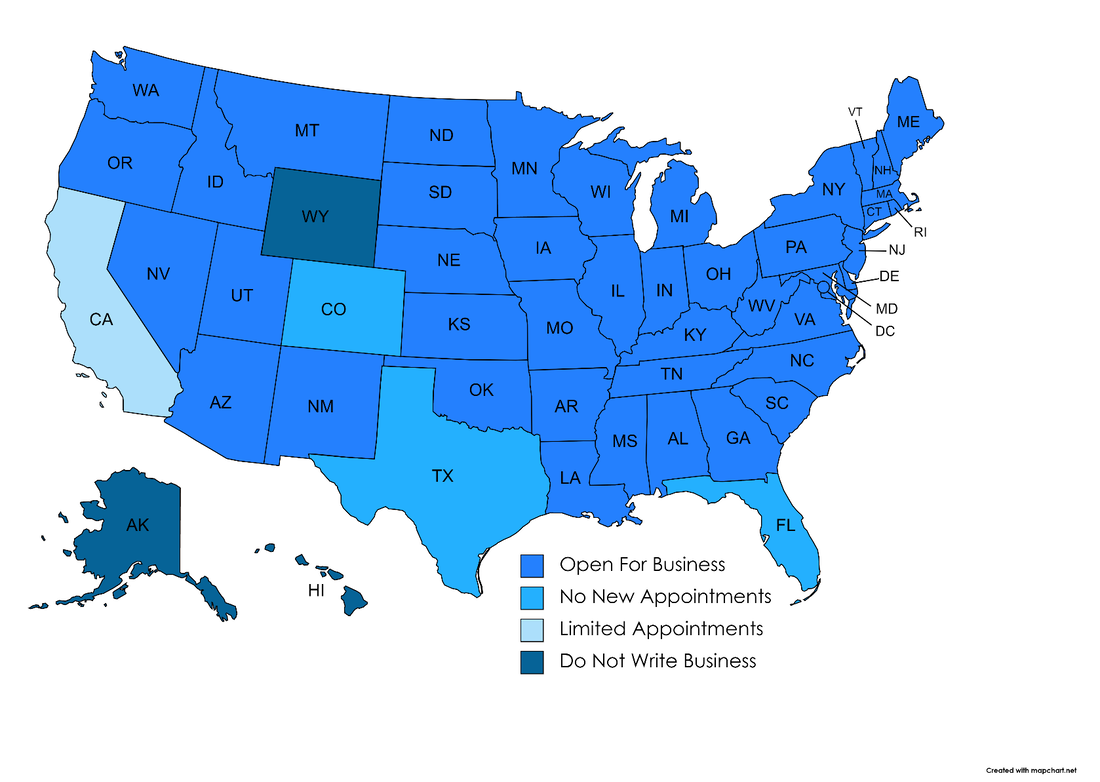

Operating Territory

|

- Why IAN

- About IAN

- Carriers/Partners

- Technology

- Programs

-

Insurance

- Associates

-

Vendors/Services

- ADP

- Agency Revolution

- Agentero

- Applied Systems

- Archway Computers

- Blue Jay Reviews

- Bold Peguin

- Bonjoro

- Bridge

- Brightfire

- Canopy Connect

- Capital Premium

- DocuSign

- epay Policy

- EZLynx

- Forge3

- Formstack

- GoDaddy

- Google Workspace

- GoToConnect

- Grasshopper

- Hawksoft

- IBQ Systems

- Indio

- InsuranceSplash

- ITC

- Levitate

- Malwarebytes

- Ooma

- Relativity6

- Ring Central

- Rocket Referrals

- Semsee

- ShareFile

- Tarmika

- Vertafore

- Virtru

- Wahve

- Wingman Cyber

- zix

- Zywave

- Access Online Documents

- Contact

- Why IAN

- About IAN

- Carriers/Partners

- Technology

- Programs

-

Insurance

- Associates

-

Vendors/Services

- ADP

- Agency Revolution

- Agentero

- Applied Systems

- Archway Computers

- Blue Jay Reviews

- Bold Peguin

- Bonjoro

- Bridge

- Brightfire

- Canopy Connect

- Capital Premium

- DocuSign

- epay Policy

- EZLynx

- Forge3

- Formstack

- GoDaddy

- Google Workspace

- GoToConnect

- Grasshopper

- Hawksoft

- IBQ Systems

- Indio

- InsuranceSplash

- ITC

- Levitate

- Malwarebytes

- Ooma

- Relativity6

- Ring Central

- Rocket Referrals

- Semsee

- ShareFile

- Tarmika

- Vertafore

- Virtru

- Wahve

- Wingman Cyber

- zix

- Zywave

- Access Online Documents

- Contact