Berkley Insurance

Company Profile: W. R. Berkley Corporation founded in 1967, is one of the nation’s premier commercial

lines property casualty insurance providers. Each of the operating units in the Berkley group participates in a niche market requiring specialized knowledge about a territory or product and has the expertise and resources to utilize their strengths in the present environment, and the flexibility to anticipate, innovate and respond to whatever opportunities and challenges the future may hold. W. R. Berkley Corporation’s® competitive advantage lies in a long-term strategy of decentralized operations, allowing each of their units to identify and respond quickly and effectively to changing market conditions and local customer needs. This decentralized structure provides financial accountability and incentives to local management and enables them to attract and retain the highest caliber professionals.

Financial Stability:

Employee, Customer and Community Oriented:

Company Highlights:

Industry Rankings:

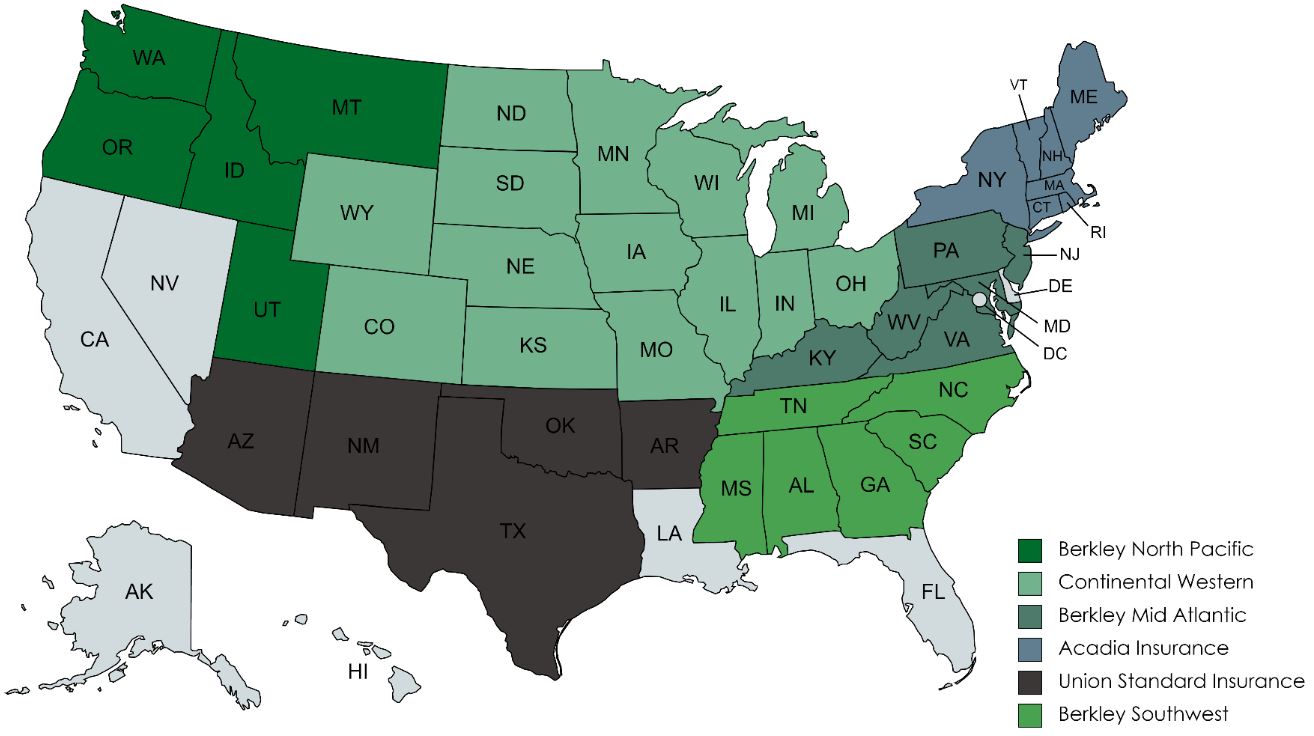

Berkley North Pacific is a regional, commercial insurance provider servicing business in the Northwest. With local leadership, conversational underwriting, as well as consultative risk management and claims services, they are we truly are a relationship driven company. Partnering with a select group of Independent Agents they pride themselves on the ease of doing business.

Continental Western Group® (CWG) has been a trusted insurance carrier since 1886. They offer a broad array of commercial insurance products for businesses in 13 states from the Rocky Mountains to the Great Lakes and their goal is to be the strong, local, and trusted choice for independent insurance agents and customers. They live and operate in the same communities as customers and available when needed most. Such local presence provides in-depth understanding of the businesses and communities they insure.

Berkley Mid-Atlantic Group knows needs are changing, the world is shifting, and are here to help. They

understand you need consistency, transparency, and the fast delivery of value. They manage risks for small, medium, and large businesses and their expertise is delivered by talented independent insurance agents and backed by exemplary service from claims, underwriting, risk management, audit, sales, and marketing teams. Acadia INSURANCE specializes in commercial property casualty insurance. The company began in 1992 insuring businesses in Maine and today offers insurance programs for small and midsize businesses throughout New England and New York State with local offices in Connecticut, Maine, Massachusetts, New Hampshire, New York and Vermont.

UNION STANDARD works with independent agents to tailor coverage to meet the unique needs of a variety of businesses. They believe your Insurance coverage should be as unique as your business and with local underwriting, claim, loss control and audit services, they’ve got you covered!

Berkley Southeast Insurance Group, (BSIG), is a regional commercial lines property and casualty

insurance provider. They partner with a select group of independent agents in Alabama, the Carolinas, Georgia, Mississippi, and Tennessee to provide commercial products and services for small and mid-sized businesses. With the resources of W. R Berkley Corporation, a Fortune 500 company, they can provide assurance to policyholders that BSIG will be there when you need them most. Products Offered

Operating Territory

|

- Why IAN

- About IAN

- Carriers/Partners

- Technology

- Programs

-

Insurance

- Associates

-

Vendors/Services

- ADP

- Agency Revolution

- Agentero

- Applied Systems

- Archway Computers

- Blue Jay Reviews

- Bold Peguin

- Bonjoro

- Bridge

- Brightfire

- Canopy Connect

- Capital Premium

- DocuSign

- epay Policy

- EZLynx

- Forge3

- Formstack

- GoDaddy

- Google Workspace

- GoToConnect

- Grasshopper

- Hawksoft

- IBQ Systems

- Indio

- InsuranceSplash

- ITC

- Levitate

- Malwarebytes

- Ooma

- Relativity6

- Ring Central

- Rocket Referrals

- Semsee

- ShareFile

- Tarmika

- Vertafore

- Virtru

- Wahve

- Wingman Cyber

- zix

- Zywave

- Access Online Documents

- Contact

- Why IAN

- About IAN

- Carriers/Partners

- Technology

- Programs

-

Insurance

- Associates

-

Vendors/Services

- ADP

- Agency Revolution

- Agentero

- Applied Systems

- Archway Computers

- Blue Jay Reviews

- Bold Peguin

- Bonjoro

- Bridge

- Brightfire

- Canopy Connect

- Capital Premium

- DocuSign

- epay Policy

- EZLynx

- Forge3

- Formstack

- GoDaddy

- Google Workspace

- GoToConnect

- Grasshopper

- Hawksoft

- IBQ Systems

- Indio

- InsuranceSplash

- ITC

- Levitate

- Malwarebytes

- Ooma

- Relativity6

- Ring Central

- Rocket Referrals

- Semsee

- ShareFile

- Tarmika

- Vertafore

- Virtru

- Wahve

- Wingman Cyber

- zix

- Zywave

- Access Online Documents

- Contact