Kemper Insurance

Company Profile: KEMPER® origins are tied directly to the general business climate of the early 20th

century. In 1912, a 25-year-old insurance salesman named James S. Kemper proposed to a group of Chicago lumber-industry leaders that they organize their own mutual insurance firm. KEMPER® family of companies today are one of the nation’s leading insurers. With $13 billion in assets, Kemper is improving the world of insurance by offering personalized solutions for individuals, families, and businesses. Kemper currently services approximately 6.4 million policies, are represented by more than 30,000 agents and brokers, employ 9,100 associates dedicated to providing exceptional service and is licensed to sell insurance in 50 states and the District of Columbia.

Financial Stability:

Employee, Customer and Community Oriented:

KEMPER® is building a culture where every employee thinks and “acts like an owner”, understands the important role they play in fulfilling the promises made to customers and strives to be world-class operators, where decisions and actions are guided by intellectual curiosity, and leverage analytic superiority as a key to build sustainable competitive advantages and advance growth.

Company Highlights:

KEMPER® family of companies is one of the nation’s leading insurers. With $14.1 billion in assets, Kemper is improving the world of insurance by offering personalized solutions for individuals, families, and businesses. Offers insurance for auto, home, life, health and valuables, services approximately 6.3 million policies, is represented by more than 30,000 agents and brokers, employs 9,300 associates dedicated to providing exceptional service and is licensed to sell insurance in 50 states and the District of Columbia. • Endorses Environmental, Social and Governance (ESG Factors). When integrated into the business strategy, analysis, and portfolio construction, ESG Factors, offer potential long-term performance advantages. Environmental

Industry Rankings:

Products Offered

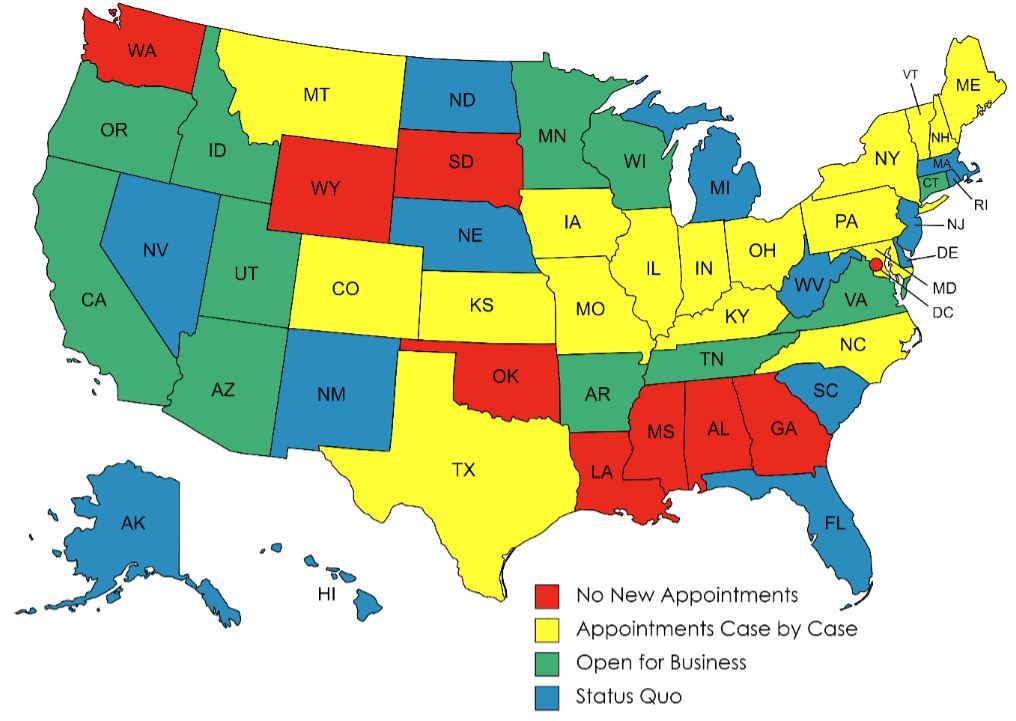

Operating Territory

|

- Why IAN

- About IAN

- Carriers/Partners

- Technology

- Programs

-

Insurance

- Associates

-

Vendors/Services

- ADP

- Agency Revolution

- Agentero

- Applied Systems

- Archway Computers

- Blue Jay Reviews

- Bold Peguin

- Bonjoro

- Bridge

- Brightfire

- Canopy Connect

- Capital Premium

- DocuSign

- epay Policy

- EZLynx

- Forge3

- Formstack

- GoDaddy

- Google Workspace

- GoToConnect

- Grasshopper

- Hawksoft

- IBQ Systems

- Indio

- InsuranceSplash

- ITC

- Levitate

- Malwarebytes

- Ooma

- Relativity6

- Ring Central

- Rocket Referrals

- Semsee

- ShareFile

- Tarmika

- Vertafore

- Virtru

- Wahve

- Wingman Cyber

- zix

- Zywave

- Access Online Documents

- Contact

- Why IAN

- About IAN

- Carriers/Partners

- Technology

- Programs

-

Insurance

- Associates

-

Vendors/Services

- ADP

- Agency Revolution

- Agentero

- Applied Systems

- Archway Computers

- Blue Jay Reviews

- Bold Peguin

- Bonjoro

- Bridge

- Brightfire

- Canopy Connect

- Capital Premium

- DocuSign

- epay Policy

- EZLynx

- Forge3

- Formstack

- GoDaddy

- Google Workspace

- GoToConnect

- Grasshopper

- Hawksoft

- IBQ Systems

- Indio

- InsuranceSplash

- ITC

- Levitate

- Malwarebytes

- Ooma

- Relativity6

- Ring Central

- Rocket Referrals

- Semsee

- ShareFile

- Tarmika

- Vertafore

- Virtru

- Wahve

- Wingman Cyber

- zix

- Zywave

- Access Online Documents

- Contact